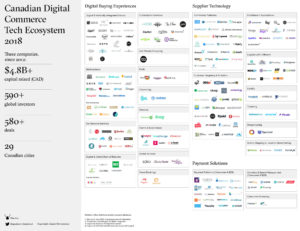

2018 Digital Commerce Ecosystem Map

The following analysis was originally published in The Globe & Mail.

In 2016, an analysis of Canada’s digital commerce landscape revealed that although consumers are increasingly shopping online, our merchants have been slow to embrace the e-commerce wave. The study recommended that Canadian merchants make use of the local technology ecosystem to help them modernize their operations for the 21st-century buyer.

Not much has changed since then. Canadians still love to shop online and we need not look further than the most recent national retail spending statistics for proof: Out of the $352-billion in retail sales generated across the country in 2016, approximately 7 per cent were made online. This proportion is expected to grow to 10 per cent by 2020.

The rise in online shopping among Canadians can be attributed to a growing need for convenience and personalization; brands and retailers have responded by expanding their digital footprints over the past few years. Since my initial study, it has also been interesting to observe that it’s not just individual consumers that are making purchases online. Business-to-business (B2B) e-commerce is an emerging technology trend with corporate buyers and sellers also opting for a seamless buying experience, one that mimics the experience they’ve become used to when shopping for themselves personally. A 2016 study revealed that nearly 50 per cent of Canadian B2B sellers generate more than a quarter of their sales online.

Although e-commerce spending in Canada continues to rise in both a consumer retail and B2B context, the extent to which we are utilizing digital commerce relative to other advanced economies is still lagging. For example, more than 10 per cent of retail spending in the United States is currently driven by e-commerce. And other estimates suggest B2B e-commerce will reach US$1.2-trillion by 2021, accounting for more than 13 per cent of all B2B sales in the United States – more than twice the size of the country’s business-to-consumer e-commerce market.

The disparity in digital commerce activity between Canada and the United States is easy to account for when considering that approximately half of all Canadian small businesses still do not have a website to conduct sales. Plus, it’s challenging to fulfil and distribute orders across the second largest country in the world. Given these obstacles, it’s no surprise that Canadian consumers send more than a third of their online spending south of the border. Some of these problems are easily addressable, while others require more attention from Canadian merchants if they’re going to be solved.

To close these gaps, my recommendation remains consistent. Our country is bustling with hundreds of fast growing technology companies that are tackling the most complex e-commerce challenges and it’s the responsibility of our merchants to keep track of the latest advancements. With the help of these businesses – summarized in this map – Canadian merchants can update their respective infrastructures and offerings to cater to a convenience obsessed customer base, in both a consumer retail and B2B context. The expertise available in Canada’s digital commerce technology ecosystem can be broken down under one of the following categories:

1. Digital Buying Experiences

Canada is a hotbed for companies developing digitally enhanced channels for commerce through which buyers can easily discover new products, services and experiences. The fundamental value proposition of these enhanced buying experiences is increased convenience, personalization and transparency, all of which have become cornerstones of the modern buying experience.

2. Supplier Technology

Digital shoppers can’t feel constricted by geography or time. They expect online merchants to be available wherever they are in order to make a purchase. A variety of local companies are developing solutions designed to help sellers increase the speed and efficiency of their services, while expanding market reach. Regardless of whether customers are shopping online or in-store, merchants need to be able to provide a consistent, timely buying experience across all channels.

3. Payment Solutions

Companies in this category are making it easy to underwrite and track financial transactions for both merchants and buyers. Although a broad range of software and hardware systems currently power instant payment options in consumer retail, B2B transactions have a longer way to go still considering a vast majority of them still take place via paper cheques. Moreover, the growing popularity of cryptocurrencies also invites merchants to contemplate the use of payment infrastructures that are compatible with these new monetary systems, which millennial buyers are increasingly experimenting with.

Since 2012, companies belonging to Canada’s digital commerce ecosystem have raised more than $4.8-billion in capital in aggregate – distributed through more than 580 deals that were led by more than 590 investors globally. These numbers have grown steadily and point to Canada’s influence within the sector.

Given all the technical expertise that exists here at home, Canadian merchants have access to all the necessary tools and resources to provide modern shopping experiences for their customers. They would be wise to keep their eyes on the local innovation ecosystem for inspiration on how to remain relevant. After all, the stakes are high and the viability of their businesses depends on it.

Have any questions or thoughts on these maps?

Looking to be included? Get in touch.