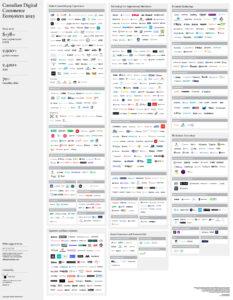

2025 Digital Commerce Ecosystem Map (Consumer + Tech)

The 2025 Digital Commerce Ecosystem Map reveals a nuanced evolution in Canada’s digital commerce landscape, underscoring both its vibrancy and persistent challenges. Featuring nearly 800 companies, the map highlights emergent sectors like green commerce and artificial intelligence, reflecting shifting priorities and innovation drivers.

Ecosystem Growth and Transformation

Since its 2016 debut with 114 companies, the map has expanded over sixfold, signaling Canada’s rising stature as a digital commerce hub. This growth mirrors technological progress and evolving consumer behaviors reshaping the industry’s contours.

Key Developments

- Sectoral Shifts: Sustainability gains prominence with categories such as Green Packaging Solutions and Carbon Reduction Initiatives, demonstrating increased environmental accountability among brands and retailers. Enterprise AI startups continue to diversify applications, signaling sustained innovation potential.

- Market Consolidation: The absence of some previously featured companies—due to mergers, acquisitions, or closures—reflects a maturing, competitive market rewarding adaptability.

- Emerging Hotspots: Blockchain and fintech remain dynamic, propelled by advances in cryptocurrencies and digital payments, attracting investment and talent.

Category Breakdown

Here’s a detailed breakdown of each category on the map, highlighting the diverse range of companies driving innovation:

Multi-Channel Buying Experiences (255 companies)

- Brands & Retailers: Integrating traditional retail with modern e-commerce strategies to enhance consumer engagement.

- Subscription Services: Offering recurring access to products or services for predictable revenue streams.

- Rental Service and Circular Economy: Promoting resource efficiency through leasing products and minimizing waste.

- Couponing: Utilizing data analytics for optimized digital voucher distribution.

- Travel Bookings: Facilitating online booking with user-friendly interfaces.

- Real Estate: Providing digital solutions for property transactions with virtual tours.

- Online Auto Dealerships & Auctioneers: Enabling online vehicle sales and auctions.

- Live Stream Shopping: Combining entertainment with commerce for real-time purchases.

- On-Demand Services: Offering immediate access to services emphasizing convenience.

- Events and Experiences: Focusing on digital ticket sales or event organization.

- Data & Rewards Marketplaces: Using consumer data for personalized rewards.

- B2B Marketplaces: Facilitating efficient business-to-business transactions.

- Brand Spotlight: Showcasing iconic Canadian craftsmanship and design.

- Marketplace: Facilitating seamless business to consumer connections.

Technology for Suppliers and Merchants (275 companies)

- E-Commerce and Point-of-Sale: Facilitating online sales transactions integrated with physical operations.

- Supply Chain Management: Optimizing logistics and inventory management.

- Ticketing and Events: Providing digital solutions for event management.

- Loyalty Programs: Helping businesses manage customer loyalty initiatives.

- Other Enabling Software: Supporting various business operations with diverse software solutions.

- Logistics and Fulfillment: Ensuring timely product delivery through efficient networks.

- Marketing, Customer Engagement, and Analytics: Enhancing marketing strategies with data insights.

- Indoor Mapping & Location-Based Selling: Assisting in navigating retail spaces or targeting consumers based on location.

- Enterprise AI: Supporting business operations through automation and predictive analytics.

Financial Technology (88 companies)

- Payments and Financial Software: Enabling secure financial transactions between merchants and consumers.

- B2B Lending: Offering financial products tailored for business needs.

- Spend Management and Analytics: Helping businesses track expenses effectively.

- Consumer Financing: Providing flexible payment options to consumers.

- On-Demand Pay: Allowing employees access to earned wages before payday.

- Insurance: Streamlining insurance product purchasing digitally.

- Personal Finance: Assisting individuals in managing finances through apps or services.

Blockchain Technology (77 companies)

- Capital Markets, Cryptocurrency Trading, and Financial Services: Facilitating secure trading of digital assets.

- Digital Collectibles and NFTs: Creating marketplaces for non-fungible tokens.

- Wallets and Money Services: Providing secure cryptocurrency storage solutions.

- Merchant Infrastructure Services & Currencies: Supporting cryptocurrency payment acceptance technologies.

- Metaverse, Social, and Browsers: Integrating blockchain into social networks or virtual environments.

- Storage, Security, and Regulatory Compliance: Ensuring secure blockchain data storage while adhering to regulations.

- Identity and Content Management: Using blockchain for secure identity verification or content distribution management.

- Community Management: Facilitating decentralized community governance using blockchain technology.

- Data: Empowering insights through innovative data solutions.

- Cryptocurrency Mining: Driving innovation in cryptocurrency mining solutions.

- P2P Marketplace & P2P Lending: Enabling seamless peer-to-peer transactions and lending.

Green Commerce and Sustainability (19)

- Green Packaging Solutions: Developing environmentally friendly packaging options to reduce waste in logistics.

- Carbon Reduction Initiatives: Helping businesses track carbon emissions while implementing reduction strategies.

Agencies and Intermediaries (75)

- Connecting brands with expertise and tailored solutions.

Contextual Landscape and Challenges

Canada’s startup ecosystem has demonstrated resilience, generating $56.5 billion in exit value from 184 companies over the past decade. However, venture capital availability has fluctuated, with 2023 and 2024 marking some of the lowest funding levels in a decade due to macroeconomic headwinds like rising interest rates and investor caution.

Furthermore, a persistent “sameness” across ecosystem maps highlights the need for more Canadian companies to scale globally, akin to Shopify, SSENSE, or Lululemon.

Addressing this requires confronting key scaling challenges such as:

- Capital Efficiency: Smaller domestic markets pressure startups to optimize fundraising and resource allocation. Median Canadian exit values (CAD $93M) lag behind U.S. counterparts (USD $141M), reflecting divergent market dynamics and capital absorption capacity.

- Market Expansion: Regulatory and cultural complexities complicate international growth.

- Infrastructure: Limited connectivity, especially in remote regions, hampers scaling.

Strategies for Scaling Success

To overcome these challenges and reinforce bigger outcomes, a few strategies can continue to be adopted:

- Prioritize Capital Efficiency: Focus on valuation discipline and maximizing exit value relative to capital raised.

- Enhance Support Networks: Leverage mentorship and executive guidance to navigate growth hurdles.

- Utilize Government Programs: Tap into incentives like the SR&ED tax credit for financial backing.

- Foster Innovation: Cultivate unique, globally impactful solutions to attract investment.

- Build Strong Teams: Assemble diverse leadership capable of steering complex growth phases.

Looking Ahead

Despite challenges, Canada’s digital commerce ecosystem holds substantial promise. Emphasizing capital efficiency, support structures, innovation, and leadership can propel scale-ups and strengthen the sector, and shifting focus from startup quantity to quality and growth will help Canada cultivate a more balanced, resilient economy.

A special thank you to Ekam Sidhu, Emily Han, and Suhana Thangathurai for co-authoring this piece with me.

Have any questions or thoughts on these maps?

Looking to be included? Get in touch.